Va fund: What to understand money fees and you can settlement costs

Creating an advance payment having another type of home is usually the point that possess people from taking the plunge from occupant so you’re able to citizen in the first place. That is why Us experts, active-duty service players, National Guard and you can reservists who might not have saved up adequate for an advance payment consider Va loans to help make homeownership a real possibility.

Virtual assistant financing allow for 100% investment of a property, meaning no down-payment needs getting eligible people. And since a beneficial Va mortgage boasts a twenty five% lender verify, PMI (private mortgage insurance policies) is not required both.

All of this saves you money over the life of your own mortgage, however, there are several out-of-pocket expenditures that are included with a good Va mortgage, and additionally typical financial closing costs and you can a great Va funding commission.

While utilizing the Va financing system an extra (otherwise 3rd otherwise fourth…) time:

Government rules requires Virtual assistant financing investment charge, but, as with any rule, you’ll find exceptions. While people purchasing a property thanks to a beneficial Va mortgage is needed to blow the brand new financial support fees, the following are excused:

- Homebuyers whom discovered Virtual assistant handicap costs getting army solution-relevant wounds

- Homebuyers that would discover Virtual assistant disability money once they were not searching old age shell out

- Homebuyers entitled to located payment, however, who are not at this time during the receipt because they for the productive duty

- Homebuyers who happen to be offering on active obligation giving proof being approved the yellow cardio

- This new thriving partners away from armed forces teams which died whilst in services, or of experts exactly who passed away due to services-relevant handicaps and you will that is searching Dependence and Indemnity Payment (DIC)

Virtual assistant mortgage settlement costs

If you’re settlement costs are often minimal with a Virtual assistant loan, homeowners may want to cover these as well. In the place of capital costs, closing costs can’t be folded into amount borrowed.

- Charges to pull credit file and you can credit ratings

- Will cost you accomplish a property title research

- Devotion from whether the home needs flooding insurance coverage

- Taxation and you can tests predicated on government, condition and you can regional rules

Most costs this new Virtual assistant lets a candidate to expend

The new Virtual assistant controls hence charge Virtual assistant mortgage individuals are going to be energized. Such smaller expenditures usually are utilized in a lump-share bank fee: normally in the 1% of your own complete amount borrowed. Next charges can get affect their Va loan application:

Fees the latest Va does not make it an applicant to invest

While some are common with antique mortgage loans, the latest Institution from Pros Facts cannot allow following the fees are billed to good Virtual assistant loan applicant:

Can also be suppliers spend Virtual assistant closing costs?

This is exactly a great exemplory case of exactly how Virtual assistant fund can help homeowners spend less. As the people by using the Va loan is restricted as to what they can also be and cannot spend when it comes to closing costs and you can other costs, extremely common having vendors to cover any of these can cost you. That is right: commonly, owner pays!

Sellers are not required to shell out a beneficial borrower’s closing costs, but it’s aren’t discussed. Pros Circumstances lets possessions manufacturers to pay a share of price toward the fresh consumer’s settlement costs, tend to doing cuatro%. However, provider concessions can also increase when they sign up to pre-paid off costs, using activities, etcpare that to help you conventional mortgages, that can limit supplier contributions into settlement costs within 3%.

Is an effective Va mortgage most effective for you?

If you’re a All of us experienced, active-obligations service associate, an effective reservist otherwise a person in brand new National loans Granby CO Protect and you are clearly looking to purchase, refinance a beneficial Va loan or have to discover more about Va homeownership masters, get in touch with united states now.

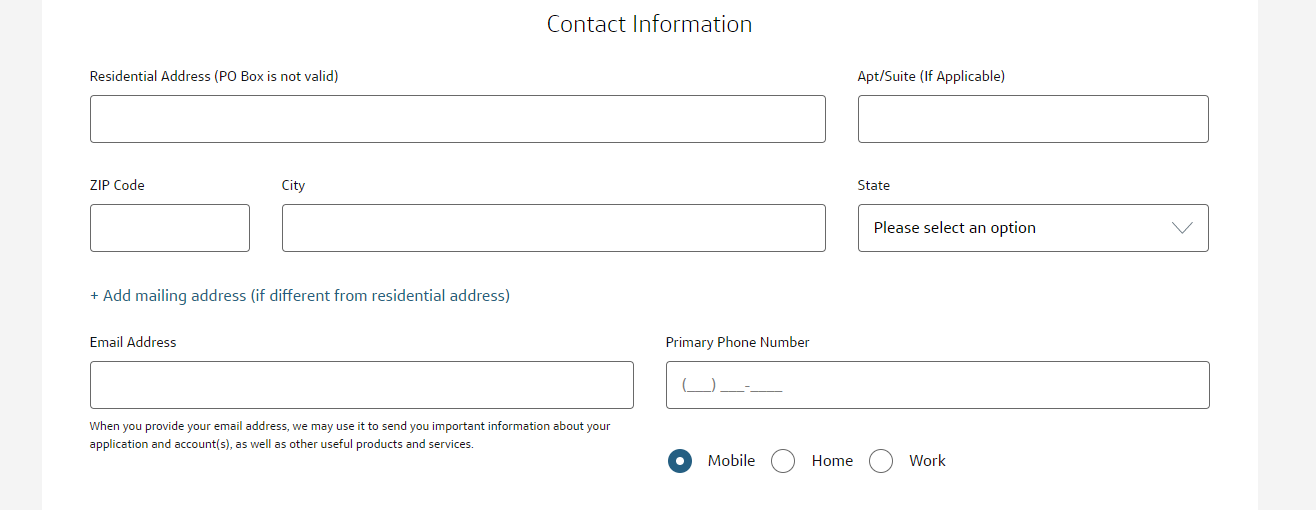

Course Home loan can answer your questions about qualifications and help you improve best decision out-of a great Va mortgage. See a loan officer in your area to get started otherwise use on the web.

Mitch Mitchell is a self-employed contributor so you can Movement’s sale agency. The guy including writes regarding technology, on the internet shelter, the digital degree society, traveling, and you may managing animals. However wish live someplace enjoying.