In accordance with the Discover Lenders section, the organization is definitely worth a closer look for the financial requires

See is best recognized for its line of credit cards, but it’s plus the full-services financial and percentage characteristics company.

Best Features

- Effortless on the internet application techniques

- No origination or assessment charge

- No cash due at closing

Cons

- No pick financing otherwise HELOCs

- House guarantee funds begin on $thirty-five,000, which might be too much for most individuals

- Zero branches having from inside the-person connections

Evaluation

The loan Profile may be compensated because of the some of the financial lenders we remark. not, this won’t connect with our very own comment procedure or perhaps the studies lenders discover. The studies manufactured on their own of the our article group. We feedback services from spouse loan providers along with loan providers we do not manage.

Come across is an electronic digital financial and you can fee services company which have you to quite approved labels when you look at the You.S. economic properties.

When you’re thinking about home financing re-finance or exploring a property security financing, Come across Lenders section can provide a personalized option to satisfy your circumstances.

You will need to view costs off a few some other lenders, so you’re able to relax knowing regarding getting the best deal on the your home loan.

Jump So you’re able to Point.

- What is actually Find?

- Find home loans remark for 2024

- Handling See

Choosing the right mortgage lender can place the origin to suit your financial achievement. Therefore obviously you want a buddies that will answr fully your inquiries and make suggestions because of each step of the process. Whether you are trying to decrease your mortgage price otherwise borrow against your own security getting a repair project, read on for a call at-breadth Come across Mortgage brokers feedback.

What’s See?

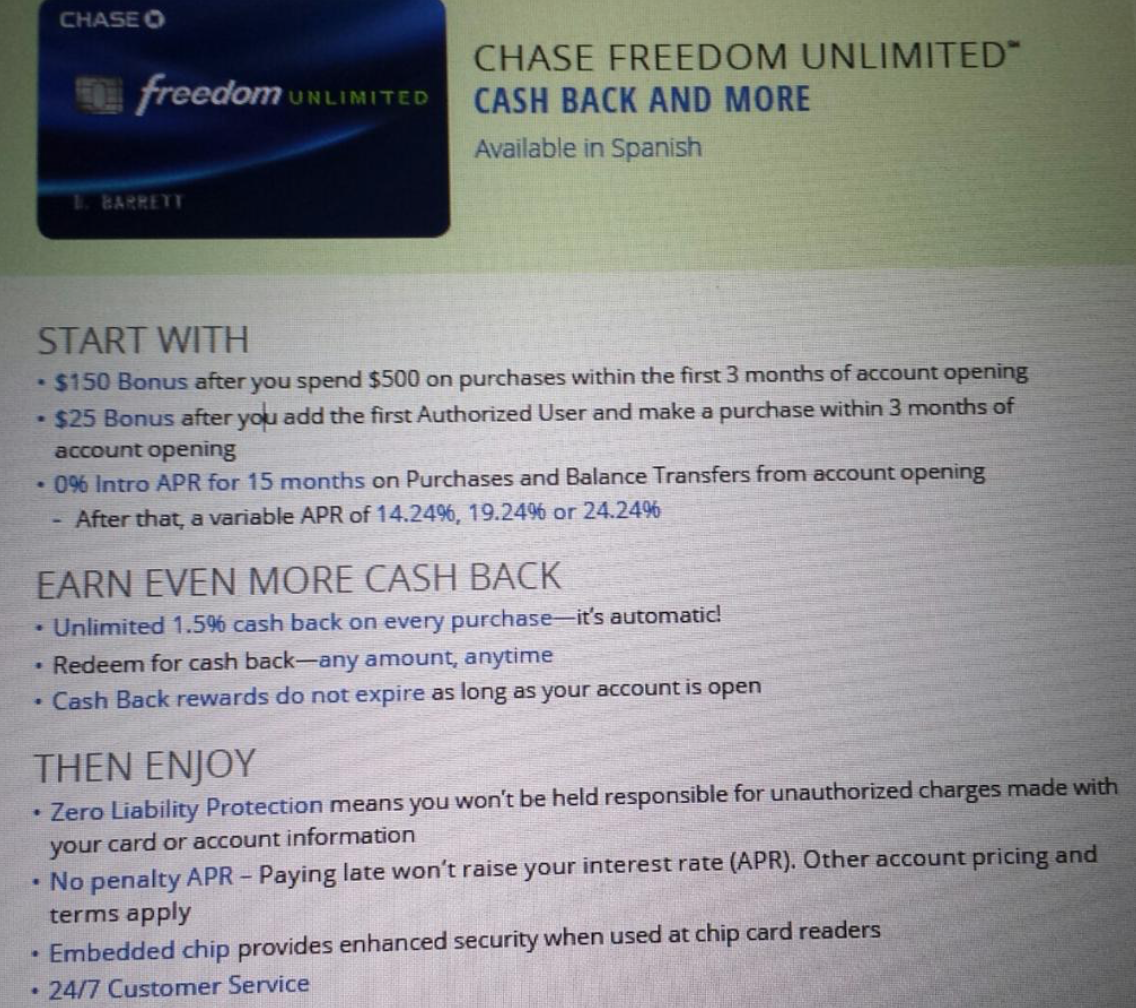

Discover try a lender which provides various situations and you will features, and playing cards, personal and you can figuratively speaking, online financial, and you may lenders.

The company are created in 1985 because a part off Sears Roebuck and you may Co., and has now once the feel a separate organization.

When you find yourself Look for are well-known for the playing cards, Get a hold of Mortgage brokers is considered the most its new items. That it financial alternative might appealing to homeowners in search of refinancing otherwise borrowing from the bank against payday loan Livingston their house collateral.

You to glamorous ability out-of Come across Home loans is the capability to rating capital with no origination costs, zero assessment costs, without cash owed from the closure. Removing such charge can help borrowers cut a lot of money.

Get a hold of home loans review having 2024

See Mortgage brokers is a mortgage lender that offers financial refinances and household security funds. Sadly, they will not already give pick funds otherwise home guarantee traces off borrowing (HELOC).

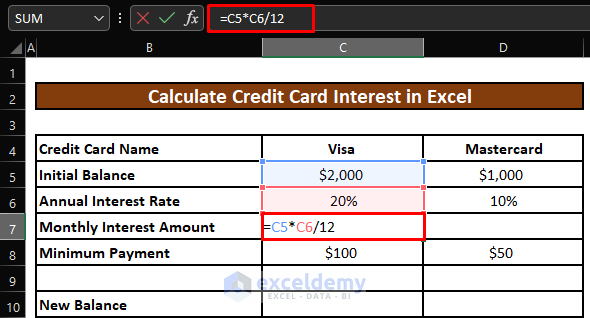

Using this financial to re-finance your current home loan may help down the payment per month and reduce the borrowed funds name. You are able to option of a varying-rates to a predetermined-speed financial. However, you should observe that Discover only even offers old-fashioned refinancing and you can does not support authorities-backed funds such FHA or Virtual assistant finance. To help you be eligible for refinancing you will need a minimum credit rating off 620.

A key advantage of refinancing which have Come across Mortgage brokers is the no-closure costs alternative. This will possibly save you thousands of dollars during the upfront charges. Alternatively, Select discusses settlement costs on the your own re-finance (appraisal fee, name insurance policies, and you can financing origination costs).

See allows individuals in order to re-finance as much as 95% of their house’s worthy of. Although not, you could potentially only acquire anywhere between $thirty five,000 and $300,000, and you may installment terms and conditions include ten to help you 3 decades.

If you don’t should refinance, another option was applying for a find household guarantee loan. You could potentially make use of your own home’s equity to finance home improvement tactics, consolidate personal debt, or cover almost every other big costs.