Whom Qualifies To own A healthcare Staff member Mortgage

Have you been a health care professional otherwise a soon to be physician otherwise an alternate medical doctor? You will be struggling significantly less than medical college or university debt and you can thought it’s impossible to get a home. A medical expert mortgage will be the treatment for your own woes.

Most people you will assume that medical professionals is actually steeped, thus of course they will have no problem buying property. Although not, this isn’t true for many physicians who’re merely starting their work.

Medical college or university personal debt, no offers, and you may a sparse specialized functions background produces delivering mortgage loans to have medical professionals a difficult task. Thankfully, you will find medical practitioner mortgage financial applications tailored exactly for this form of regarding condition.

What is actually A health care professional Mortgage Mortgage?

Doctors will stumble on problems whenever obtaining a normal financial at the start of their industry because of an enormous financial obligation-to-money proportion (DTI) once going right through several years of college or university and you may scientific school. They could not have any coupons, and can’t even offer proof a career and you may income when they’ve recently graduated if you don’t when the obtained recently been the property.

A health care provider home loan takes into account the point that medical professionals looks bad in writing at the start of the career, but their income will most likely make up for they. This sort of financing usually doesn’t require a downpayment from people count, and you can in lieu of almost every other no-down-payment mortgages, there is zero importance of personal mortgage insurance rates (PMI).

Although it may seem odd to possess too many preferred standards for financial application recognition to get waived because somebody is actually a great doctor, banking companies usually are prepared to generate conditions having doctors based on their projected industry trajectory. Chances of mortgage being paid off is higher, plus the notice to the a no-down-commission mortgage is actually significant.

Just how Mortgage loans To have Doctors Performs

Mortgage loans for physicians are typically made available through a new program and you will work in a different way off antique mortgage loans in a lot of areas. The theory will be to guarantee that doctors can buy a beneficial family of their own far prior to when they might when they had to wait to get to know all the criteria of a normal mortgage.

You will find some variations about the particular possessions you can get with a healthcare professional mortgage compared to the a conventional mortgage. Instance, you will likely end up being simply for only solitary family members homes, apartments, townhomes or functions having all in all, dos units. You’ll also be expected to use the house as the an initial residence, so zero travel residential property otherwise resource features underneath the program.

Medical professional funds may be used from the more physicians. When you find yourself currently practicing medicine within the adopting the characteristics, otherwise could well be exercising contained in this 90 days regarding financing closure, it’s also possible to qualify for an interest rate having physicians or healthcare workers:

- Scientific citizen otherwise other

- Medical doctor

- Expertise doctors

- Surgeon

- Chiropractor

- Pharmacist

- Dentist

- Veterinarian

Positives and negatives off Mortgages For Physicians

Physician mortgage loans bring several benefits more than conventional mortgage loans for new medical professionals and you may health care positives looking to buy a property. Here are a few positives and negatives to take on whenever deciding if the a health care professional financing is right for you.

- Can’t be eligible for a normal home loan

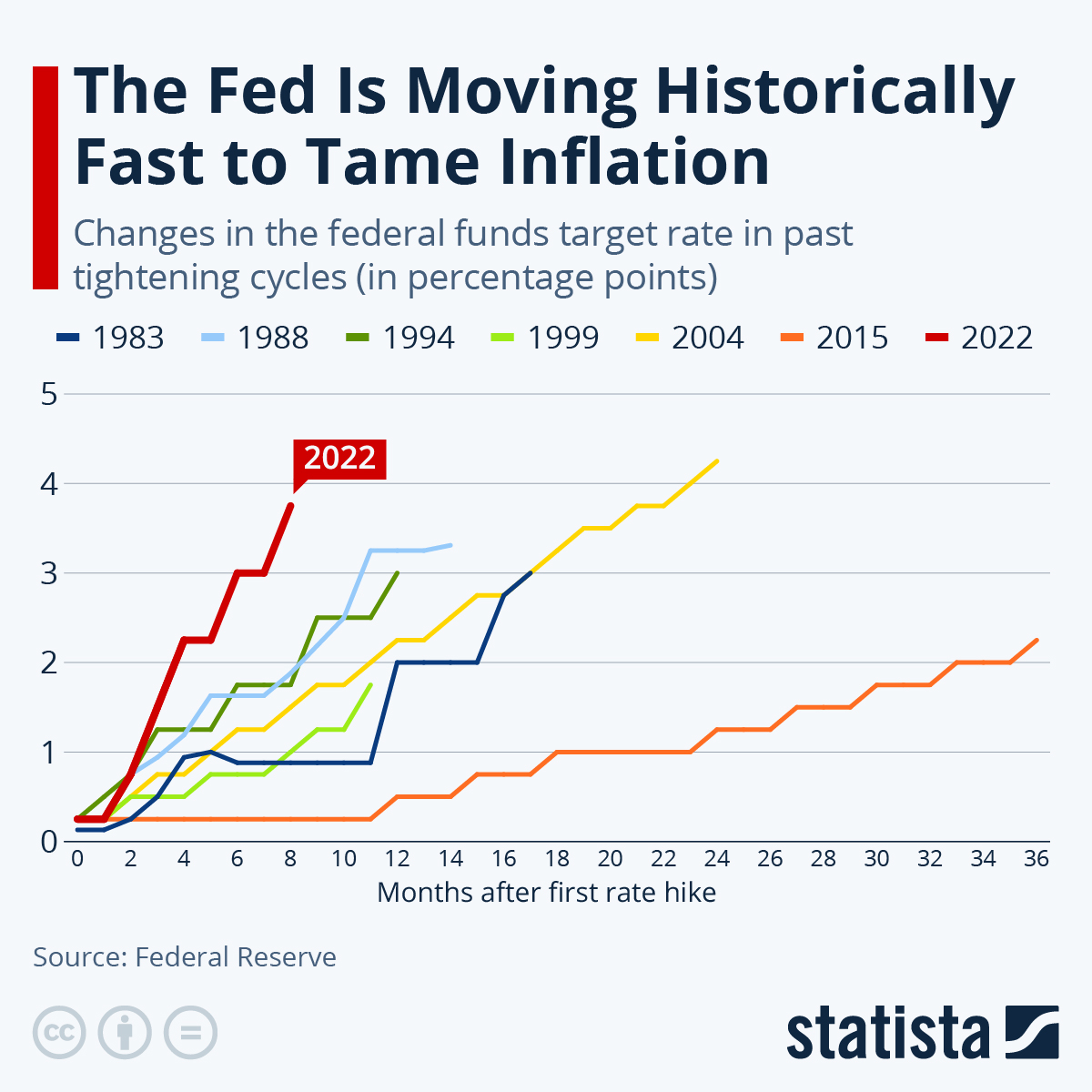

Of a lot mortgage loans to possess doctors have a number of parameters for the the eye side. First, the rate of interest will probably be quite increased over you to definitely to possess a conventional home loan. Next, you might be impractical as given a predetermined rates; extremely doctor money are set right up while the adjustable rates mortgages (ARMs). This is where you have got a predetermined speed for some age you to changes so you’re able to a variable rate next the initial time frame was upwards.

There is a risk with the starting their homeownership travel for the a loan having a hundred% LTV proportion. Since you will not have people equity in your home, when the home prices lose, could cause owing more than our home is really worth. This can be also known as being underwater on your mortgage, and it can succeed hard to refinance or sell your domestic.

Physician Money Out of Sammamish Financial

Do not let student loan personal debt or restricted discounts stop you from having home. Doctors need an identical chance yourself control because the someone else.

As to why Choose Sammamish Mortgage?

Within Sammamish, we think folk have to have the opportunity to purchase property. Our very own physician mortgage programs are created to help you during the doing your house control travel today in the place of prepared ages.

Sammamish Home loan has been doing business as 1992, possesses assisted many homebuyers from the Pacific Northwest. If you are searching to own home loan financing inside Washington Condition, we can let. Sammamish Mortgage offers financial software inside https://www.cashadvancecompass.com/personal-loans-nv/las-vegas the Colorado, Idaho, Oregon and Arizona, together with our very own Diamond Homebuyer System, Cash Client Program, and you will Link Fund.

Call us when you have any financial-related inquiries otherwise questions. If you are happy to move forward, you can see rates, obtain a customized instantaneous speed offer, otherwise apply quickly right from all of our webpages.