$fifty Loan Instantaneous App: QuickEasy Way of getting Financing

The instant $50 loan app will assist you with quite a few problems such as for instance an excellent flat tire, particularly for individuals who alive pay-to-spend. When you’re powering in short supply of dollars if you have simply one week left to earn an income. Brief money thanks to these types of mortgage software can help with cash needs. Discover how these types of programs you are going to aid you.

- Pay day loan: Short-identity borrowing to the people who are over the age of 18.

- Signature loans: Obtain of $ five-hundred so you can $ 10000

- Poor credit Fund: Short mortgage $a lot of $35000

Instant software to possess $50 finance: Cashmama

Cashmama are a software having instantaneous financing that can help you finances your money giving cash advance, letting you spread their loans ranging from paydays. Hence, i rating it a knowledgeable immediate financing application to possess $fifty.

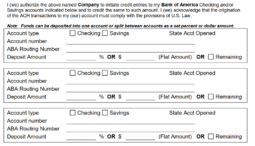

To partner with Cashmama, you will need to hook up your existing checking account that have an enthusiastic productive reputation of two months. As well, the account’s balance is most recent, therefore have to have at the least around three deposits right from the fresh workplace.

When your membership was open, you can request cash advances through to the 2nd shell out months. Predicated on your earnings, you can lend doing $250.

Cashmama try a loan application that automatically transmits dollars to your account and in case an issue is at risk for being overdrawn. Cashmama may also assist you in finding the opportunity to secure additional earnings when you need it.

As the basic subscription so you can Brilliant is entirely totally free, you can easily accessibility really keeps in the applying. New up-date so you can Cashmama Also was $9. 99 monthly. There are entry to immediate funds should you need to have the money.

Quick application financing $ fifty $ 100: Ezloans

Ezloans are just offered since the a checking account towards the a credit card applicatoin getting cell phones. The fresh new software is designed to allows you to purchase less costs and get a hold of an easy way to reduce your expenses more effectively.

It Immediate app now offers an excellent $fifty financing that will offer you money in lower than two days. This particular feature will assist you in common the expenses down from the very early percentage of paycheck. On the other hand, you’ll extend your bank account so you can all in all, $one hundred 100% free.

The very last aim of Ezloans will be the possibility of a good reimburse utilizing your pump card. In lieu of wishing to the money to perform, you can pump gasoline and make use of the cash instantly.

Its really worth detailing one to Ezloans provides an account on zero cost; although not, you only pay $4.99 to access this new superior membership with the most away from has actually. There was, not, a choice of a shot ages of 1 month for your requirements to test whether you’re happy with this service membership before carefully deciding so you can shell out.

Quick loan application between $ fifty $ 1000: Chime

The moment app to have funds out-of $50 Chime is a quick and easy way to get a financing. Chime are a software one to links the new Chime Paying https://paydayloanalabama.com/winfield/ Membership. Through this application, you should buy your commission in under two days.

The fresh new application will alert you you have generated an order following deliver the count. If you find that you definitely have not licensed a transaction, you might cut-off they immediately because of the pressing it.

While doing so, you should use the fresh SpetMe service to transfer funds to the make up $a hundred without paying people charges. When your second paycheck happens, up coming Chime will need with the rest of the amount instantaneously. This particular feature can fit the following paycheck.

The most significant benefit of Chime is that you could use your bank account with no prices. As opposed to asking lender costs, Chime brings in currency when you move on your own charge card. So, you will get the advantage of this particular feature to help you into the so it is started rates-effortlessly.

Instant application for the loan $50 $500: MoneyLion

MoneyLion was an alternative you can consider to grow their dollars supplies ranging from paydays. Permits you to get your earnings two days before and you may provides you with the opportunity of brief financing at no cost.

If you have an account which have a great MoneyLion Membership, you could potentially decide on new Insta Cash option. You can aquire doing $250 when you look at the bucks with no price of appeal at any point.

On the other hand, you don’t have to spend monthly charges to utilize this specific service. The only costs you are accountable for ‘s the Instacash for an excellent cash-on-the-destination transfer. not, you can get gone the charge if you impede a great times prior to getting your bank account.

Application: Earnin

Earnin are an application one allows you to sign up for a loan facing your upcoming salary without having to pay charges otherwise attention. When you’re doing work in a position in which their income are transferred directly from the lending company account you really have, Earnin helps you.

After you have done the applying, Earnin often relationship to your money to confirm which you provides a payment program. Whilst validates the brand new payments, the application may also dictate the brand new each hour mediocre grab-home pay.

If the app provides a concept of extent you can earn within the a normal hr, new application keeps info from how much you have made when youre at the job each day. New software tracks their phone’s venue by the GPS in your tool or conserves their schedule to create probably the most direct checklist of one’s performing period.

It is possible to withdraw the fresh new income that you’ve done; although not, you are not paid off to date. In the event that second shell out go out is in your bank account from the lender, Earnin is also immediately just take an excellent deduction on the amount borrowed.

If it is the first big date utilising the app, you could just withdraw $100 for each and every spend months. Shortly after using a routine app, you can withdraw around $five-hundred from inside the fee several months in advance of your income day.

There aren’t any charges for this specific service. But, you can utilize it budgeting application to support recommended tips based on your allowance.

rates of interest credit score control your earnings credit assessment credit score assessment life paycheck to income bit offer funds credit unions providers go out hidden costs borrow funds today longterm